As an art and an industry, technical writing has donned various hats and shapes. It evolved from a ‘communication device to accomplish a task’ to a fleshed-out, fully-fledged machine supporting countless niches and complexities of the world.

It matters even more in the financial realm.

Money defines our decisions, and vice versa, in big and small hands alike. When you double it tenfold, big institutions and mammoth industries overhaul millions of transactions at the speed of light. For instance, Razorpay, one of the largest FinTech players in India, processed a Total Payment Volume (TPV) of $150 Billion in 2023.

A lot matters in enabling these transactions. Technical communication is one of the pillars that upholds product and business trust. It augments users’ understanding and usage of the products and services through transparency and accessibility.

There is, however, a lot more than what meets the eye. In this blog, let us deep dive into the role of technical writing in the financial industry and the many ways it has come to shape.

The Early Days

The online literature for the early days of technical writing is very sparse. Its evolution is an interesting story, but technical documentation efforts in fintech get buried amongst the industry’s regulations and compliance changes. Documentation is deeply integrated into these developments.

As such, my references for the article are a combination of online research and our latest TalkX episode that delved into how financial tech writing came about.

In finance, most discussions revolve around exchanging money and goods, as well as related communication and information. Sometimes, they aim to bring awareness towards a better deal or highlight a recommended process. Other times, it’s for standardising processes for an organisation, decision-making and documenting, or raising capital via stocks.

Finance has evolved dramatically, and agents of such communication, whom we now know as technical writers have huddled around these changes and grown simultaneously.

This became apparent with the advent of the telegraph and fax machines. By the 90s, technical writers were not only subject-matter experts anymore but also the primary proponents of these machines. Consider the following questions:

How did you use these machines? What format does a fellow follow to depict a Balance Sheet? What program connects the mainframe computer to the back-end operations? How do the complex banking and financial systems like SWIFT, ATMs, and more work?

The Unique Case of Tech Writing in Financial Industry

There is one unique thing that separates tech writing from most industries when it is applied to the financial industry. Gopalakrishnan Tharoor, a persevering technical writing veteran from our latest TalkX session, elaborates that to navigate these waters—where financial information has grown complex and outsourcing avenues quickly gained speed in the 90s— ‘focus’ had to join hands with systems.

“Fin-tech prizes focus,” began. He gave us a glimpse of CMMI guidelines strictly adhered to in 80-page printouts, finally to be presented to the project managers. These were detailed protocols, annual reports, prospectuses, white papers, and more for a renowned bank. They fall at the mercy of intense rework should any information be more or less necessary.

As you can imagine, these were all boringly lengthy and taxing. Where outsourcing was accumulating the spotlight, a single-minded focus had to shake hands with collaboration; he emphasised, “To prioritise the focus, you need systems. Well-oiled systems make or break documentation.”

Importance of Systems

For focus to remain at the centre of the venture, participants in the financial operations process must be immune to structural challenges, which was only possible with systemic efforts and strict protocols.

- Systems are an antidote to the dynamic financial landscape.

- Systems enforce discipline. Writers strictly adhere to writing protocol and collaboration processes to facilitate the smooth making of changes to the documentation.

- Systems empower accuracy, transparency, and literacy.

It made sense. We are talking of an era before the omnipresent internet, where collaboration, communication, management and more happened without modern software tools. Remove any cog from this wheel, and you get documentation that is a dead man’s dream—non-existent, inefficient and wasteful.

Image from Kelly Sikkema, Unsplash.

Balanced Writing

Another unique component that redefines financial tech writing is the distinctive balance it strikes between expert and novice writing. What does that mean?

Money matters are overwhelmingly universal. Every single person and institution deals with money in some structure. It is unlike most industries that more often than not, cater heavily to an audience of subject-matter experts. Think medicine, engineering, aeronautics and more.

Indeed, within money matters, different organisations exist for various monetary use cases. These included stock brokers and payment gateways, who perform fundamentally monetary but functionally different work.

But, the profile of a financial product user cannot be classified so easily. Yes, audience research helps, but the lack of context for a non-technical audience can easily deter and discourage the users. Most customers tend to have an idea. But how do we elevate users from awareness to literacy? That is a challenge unique to the financial industry.

Tech writers tackle this interesting challenge: to explain the structure of the information and contextualise that structure simultaneously. A great example is how we developed documentation for rather approachable, merchant-facing products/topics like Payment Gateway, Subscriptions, and more, in contrast to developer-friendly API/Integration documentation.

Prioritising Documentation

We have seen that technical writing has grown alongside financial products and the tools to use such products. But why did we even need documentation for that?

Consider Razorpay, for example. We help businesses accept payments in a B2B or D2C space. But we also provide Source to Pay options to manage money, control outflow and categorise it. Then, there are credit products such as Razorpay Line of Credit and RazorpayX Corporate Cards.

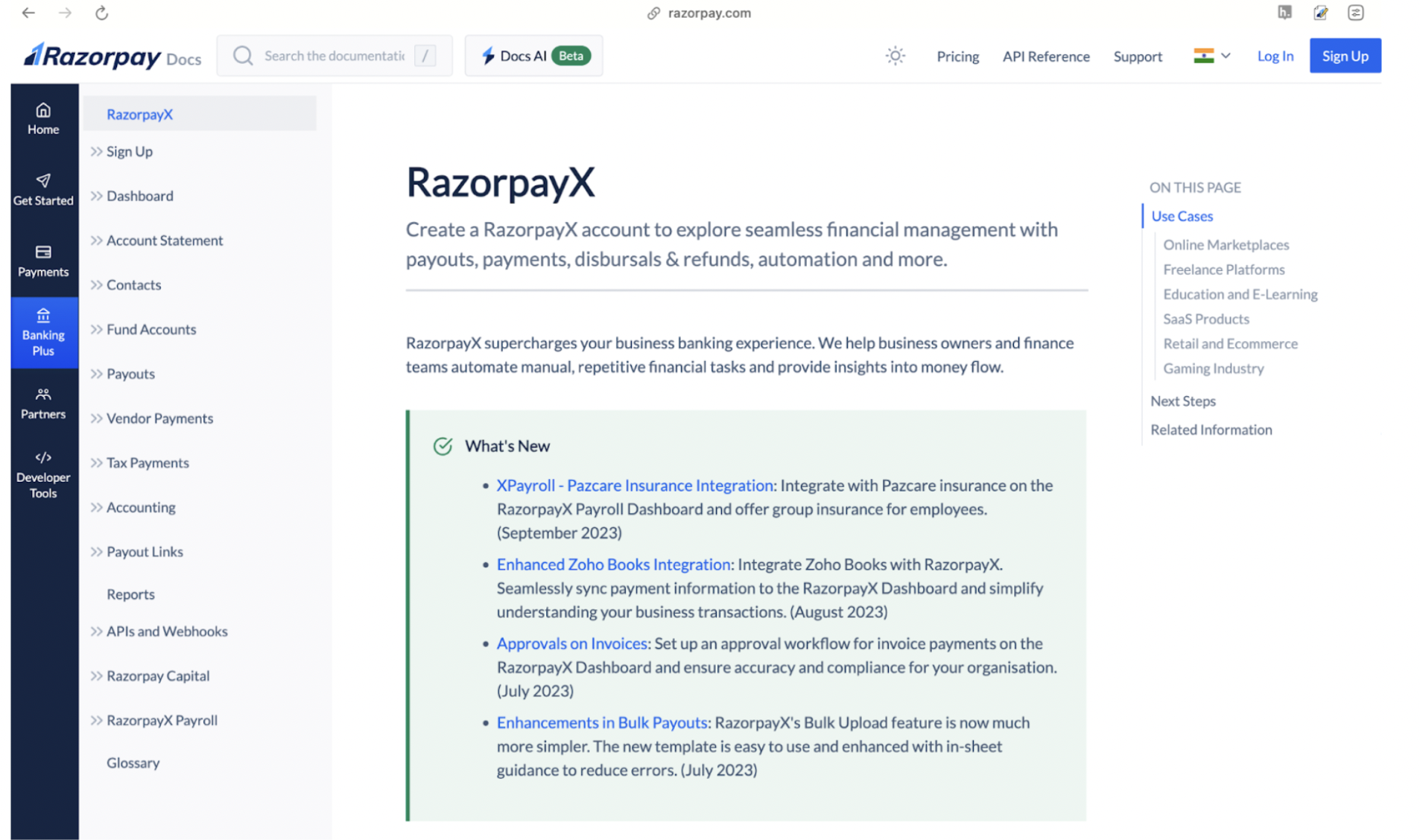

You can notice the product suite is almost endless. Is there any indiscriminate common ground for both a beginner and the biggest corporations to start from? Yes. Razorpay Docs.

Besides being a starting point, documentation broadcasts easy-to-consume, transparent product information to the users at the get-go, very stylishly and in an accessible manner.

What else does it do?

Create Awareness

“Documentation gives you more information. Clear and structured information,” Raghuram Pandurangan, a Senior Tech Writing Manager at PayU, said during TalkX. He went to great lengths to uncover tech writing’s innate ability to market efficient product use.

“There are multiple Payment Gateway integration types, each with specific benefits. Having documentation that lists down everything—process, steps, use cases, errors and more—it gives a clearer picture of the process to the end consumer and enforces better decision making.”

Enable Financial Literacy

Remember that fact about moving users from mere awareness to product literacy?

Vinita Jagannathan, Lead Technical Writer with Razorpay, mentioned during the TalkX episode that, “The financial domain is vast. We cannot know who is coming to the documentation site for what reason and with what expertise.

“So knowing this fact—that we will have users arrive at the Docs platform with very limited knowledge— enhances the tech writers’ personal expertise and ethos. It forces us to consider our role and responsibility to present information that welcomes all users. And we welcome them to communicate the end goal—here is how you can successfully complete the integration.”

That is one aspect of creating literacy. Vinita goes on to also highlight how it educates users on the best practices using the documentation site. “Be it security or legal awareness that supports a product—we highlight most of it on our docs. That is what creates strong documentation and enhances product literacy.”

And it applies not only to the kind of information presented. It also matters how you are presenting this information. “We use screenshots and videos, gifs, diagrams, checklists, best practices guides and much more on the documentation. All of these are the various ways we present information for the users to consume, ensuring it is accessible,” she added.

Precise Precision

However, all those efforts are in vain if the documentation does not have up-to-date and precise information. Exactness, correctness and accuracy are critical in fintech.

“You cannot have a developer come to the APIs and find inconsistencies or wrong information. These are money matters,” Vinita explained.

Lack of accuracy is costly to all the parties involved. It unnecessarily lengthens the resolution processes and provides a poor user experience.

Raghuram highlights a critical aspect of documentation here: collecting feedback. “To keep information precise and absolute, we must round up the latest news, deep dive and research to bring out the most accurate information.

“But once it is out there, we must also have ways to correct the documentation if more information is available to add. We can do this by collecting feedback.”

Security and Compliance

The greatest challenge of them all is to share secure and compliant information that is up-to-date. Financial technology is largely digital now, which poses a great security risk to the information in transit. Data leaks, cyber frauds, phishing, and scams are all possible, with even the most minute access to the most vulnerable information. Exploitation knows no bounds.

Consider the example where a screenshot or a video that shows an active phone number belonging to a person is publicly available. If we do not care to hide such sensitive information, it can very easily be misused. The same goes for financial information like bank accounts or VPA/UPI details. This is why most screenshots, files and videos you see on docs are masked or contain imaginary numbers.

Another aspect of security in documentation is to provide users with the security certificates binding the organisation. All certifications—PCI DSS, SOC and ISO, and encryption and authentication- must be publicly available so that users can be aware and exercise their rights.

In Conclusion

These are insights into creating world-class documentation in the financial industry and what goes on in technical writers’ minds when we think of documentation. There are other aspects towards documentation, and we’ve covered only one part of the mammoth industry: FinTech.

Yet, no matter which area of FinTech we venture into, these principles remain intact: accessible, accurate and contextual documentation.